Economia

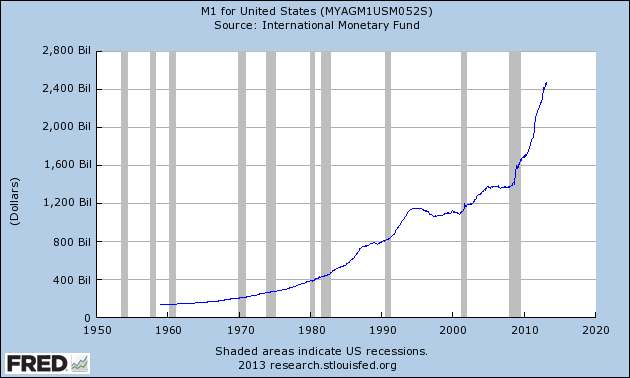

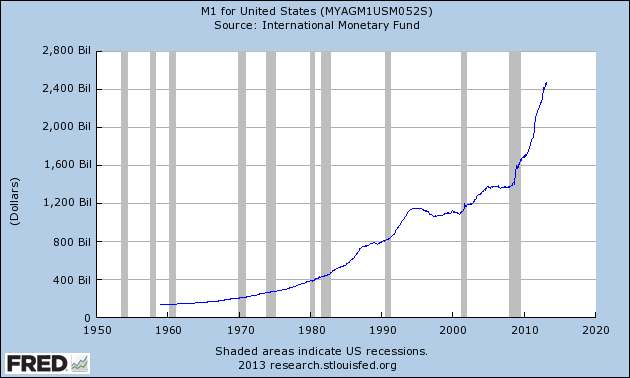

M1 comprises (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of other depository corporations; (2) traveler's checks of nonbank issuers; (3) demand deposits at commercial banks (excluding those amounts held by other depository corporations, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (4) other checkable deposits (OCDs), consisting of negotiable order of withdrawal (NOW) and automatic transfer service (ATS) accounts at depository institutions, credit union share draft accounts, and demand deposits at thrift institutions. Seasonally adjusted M1 is constructed by summing currency, traveler's checks, demand deposits, and OCDs, each seasonally adjusted separately.

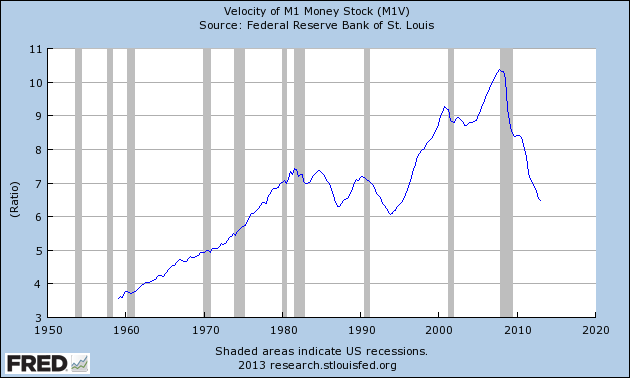

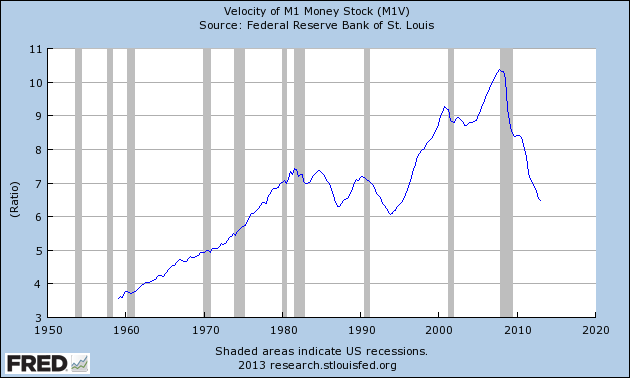

Velocity is a ratio of nominal GDP to a measure of the money supply. It can be thought of as the rate of turnover in the money supply--that is, the number of times one dollar is used to purchase final goods and services included in GDP.

- E Se "salvar" Os Bancos Não For Suficiente ?

(Re)lendo o relatório do FMI (Global Financial Stability Report) notei (pag. 24) que do 1,4 milhões de milhões de dólares de estimativas de perdas "apenas" 725-820 mil milhões (ou seja cerca de 55%) afectam os balanços dos bancos. Do restante, 150-250...

- Padrão Ouro

"In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone...

- Depósitos Bancários

"In a fractional-reserve banking system ‘deposits’ are not deposits (i.e. contracts for safe-keeping) but loans to banks and thus loans to highly leveraged businesses." http://detlevschlichter.com/2013/03/cyprus-and-the-reality-of-banking-deposit-haircuts-are-both-inevitable-and-the-right-thing-to-do/...

- Economia Monetária - Política Monetária Atual

O Banco Central do Brasil facilita liquidez: -- Sept. 24 (Bloomberg) -- Brazil eased rules on reserve requirements that banks must keep at the central bank in response to the credit crunch sparked by the U.S. financial crisis. Banco Central do Brasil...

- Mr. Bernanke Explica Coordenação De Políticas De Bancos Centrais

Com o colapso dos mercados monetários internacionais, ação coordenada de BC's se fez necessária e o mecanismo utilizado é o de swaps cambiais (currency swaps). Mr. Benanke explica, em recente palestra no Banco Central Europeu: "The emergence...

Economia

M1 e sua velocidade Estados Unidos

M1 comprises (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of other depository corporations; (2) traveler's checks of nonbank issuers; (3) demand deposits at commercial banks (excluding those amounts held by other depository corporations, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (4) other checkable deposits (OCDs), consisting of negotiable order of withdrawal (NOW) and automatic transfer service (ATS) accounts at depository institutions, credit union share draft accounts, and demand deposits at thrift institutions. Seasonally adjusted M1 is constructed by summing currency, traveler's checks, demand deposits, and OCDs, each seasonally adjusted separately.

Velocity is a ratio of nominal GDP to a measure of the money supply. It can be thought of as the rate of turnover in the money supply--that is, the number of times one dollar is used to purchase final goods and services included in GDP.

loading...

- E Se "salvar" Os Bancos Não For Suficiente ?

(Re)lendo o relatório do FMI (Global Financial Stability Report) notei (pag. 24) que do 1,4 milhões de milhões de dólares de estimativas de perdas "apenas" 725-820 mil milhões (ou seja cerca de 55%) afectam os balanços dos bancos. Do restante, 150-250...

- Padrão Ouro

"In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone...

- Depósitos Bancários

"In a fractional-reserve banking system ‘deposits’ are not deposits (i.e. contracts for safe-keeping) but loans to banks and thus loans to highly leveraged businesses." http://detlevschlichter.com/2013/03/cyprus-and-the-reality-of-banking-deposit-haircuts-are-both-inevitable-and-the-right-thing-to-do/...

- Economia Monetária - Política Monetária Atual

O Banco Central do Brasil facilita liquidez: -- Sept. 24 (Bloomberg) -- Brazil eased rules on reserve requirements that banks must keep at the central bank in response to the credit crunch sparked by the U.S. financial crisis. Banco Central do Brasil...

- Mr. Bernanke Explica Coordenação De Políticas De Bancos Centrais

Com o colapso dos mercados monetários internacionais, ação coordenada de BC's se fez necessária e o mecanismo utilizado é o de swaps cambiais (currency swaps). Mr. Benanke explica, em recente palestra no Banco Central Europeu: "The emergence...