Economia

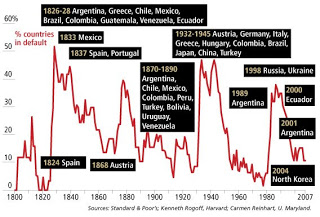

Sovereign defaults--when a country stops paying its bills--go in waves, often following global financial crises, wars or the boom-bust cycles of commodities. Some countries, like Spain and Austria, mend their ways; others, like Argentina, are repeat offenders. Leia mais: http://www.forbes.com/forbes/2010/0208/debt-recession-worldwide-finances-global-debt-bomb.html?boxes=Homepagemostpopular

Sovereign defaults--when a country stops paying its bills--go in waves, often following global financial crises, wars or the boom-bust cycles of commodities. Some countries, like Spain and Austria, mend their ways; others, like Argentina, are repeat offenders. Leia mais: http://www.forbes.com/forbes/2010/0208/debt-recession-worldwide-finances-global-debt-bomb.html?boxes=Homepagemostpopular

- Fim Do Jogo

Endgame: The End of the Debt SuperCycle and How It Changes Everything Greece isn’t the only country drowning in debt. The Debt Supercycle—when the easily managed, decades-long growth of debt results in a massive sovereign debt and credit crisis—is...

- Dívida Macroeconômica - Mapa Interativa

THE headlines are all about sovereign debt at the moment. But that is only part of the problem. Debt rose across the rich world during the boom, from consumers maxing out credit cards to financial firms taking on more leverage, and the process of reducing...

- A Rede Da Divida Soberana Europeia

Credit-Default Swap Risk Bomb Is Wired to Explode: Mark Buchanan The European sovereign debt crisis stands as the latest in a long line of similar crises. Argentinain 2001. Russia in 1998. Mexico in 1994. The list goes back into history. Debt crises...

- A Orígem Da Crise Financeira

John B. Taylor: "... My research shows that government actions and interventions -- not any inherent failure or instability of the private economy -- caused, prolonged and dramatically worsened the crisis. The classic explanation of financial crises is...

- É A Dívida Pública, Estúpido! Parte Ii

Um continente de más idéias: John Cochrane discute os problemas de endividamento público na Europa e repercussões sobre o Euro: "Conventional wisdom says that sovereign defaults mean the end of the euro: If Greece defaults it has to leave the single...

Economia

História de "sovereign defaults" - o não-pagamento da dívida externa de países

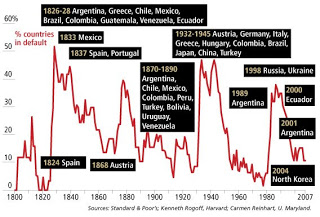

Sovereign defaults--when a country stops paying its bills--go in waves, often following global financial crises, wars or the boom-bust cycles of commodities. Some countries, like Spain and Austria, mend their ways; others, like Argentina, are repeat offenders. Leia mais: http://www.forbes.com/forbes/2010/0208/debt-recession-worldwide-finances-global-debt-bomb.html?boxes=Homepagemostpopular

Sovereign defaults--when a country stops paying its bills--go in waves, often following global financial crises, wars or the boom-bust cycles of commodities. Some countries, like Spain and Austria, mend their ways; others, like Argentina, are repeat offenders. Leia mais: http://www.forbes.com/forbes/2010/0208/debt-recession-worldwide-finances-global-debt-bomb.html?boxes=Homepagemostpopular

loading...

- Fim Do Jogo

Endgame: The End of the Debt SuperCycle and How It Changes Everything Greece isn’t the only country drowning in debt. The Debt Supercycle—when the easily managed, decades-long growth of debt results in a massive sovereign debt and credit crisis—is...

- Dívida Macroeconômica - Mapa Interativa

THE headlines are all about sovereign debt at the moment. But that is only part of the problem. Debt rose across the rich world during the boom, from consumers maxing out credit cards to financial firms taking on more leverage, and the process of reducing...

- A Rede Da Divida Soberana Europeia

Credit-Default Swap Risk Bomb Is Wired to Explode: Mark Buchanan The European sovereign debt crisis stands as the latest in a long line of similar crises. Argentinain 2001. Russia in 1998. Mexico in 1994. The list goes back into history. Debt crises...

- A Orígem Da Crise Financeira

John B. Taylor: "... My research shows that government actions and interventions -- not any inherent failure or instability of the private economy -- caused, prolonged and dramatically worsened the crisis. The classic explanation of financial crises is...

- É A Dívida Pública, Estúpido! Parte Ii

Um continente de más idéias: John Cochrane discute os problemas de endividamento público na Europa e repercussões sobre o Euro: "Conventional wisdom says that sovereign defaults mean the end of the euro: If Greece defaults it has to leave the single...