Economia

- Os Novos Ricos, Que Afinal Somos

Qualquer semelhança com a nossa realidade não será pura coincidência: An African American family with the same income, family size, and other demographics as a white family will spend about 25 percent more of its income on jewelry, cars, personal...

- O Programa Para A Participação "voluntária" Dos Investidores Privados

De acordo com um documento divulgado pelo Institute of International Finance, o programa para a participação "voluntária" dos privados envolverá a troca dos títulos de dívida gregos por uma combinação de quatro instrumentos: "1) A Par Bond Exchange...

- Previdência

— BRAZIL: Brazil is ranked second-best of 20 countries evaluated by the Center for Strategic and International Studies for maintaining retirees' incomes. But it's only No. 18 in its ability to pay for its retirement system over the long term....

- Bailout - Quem Recebe "ajuda"?

Matt Tibbi: "... There are plenty of people who have noticed, in recent years, that when they lost their homes to foreclosure or were forced into bankruptcy because of crippling credit-card debt, no one in the government was there to rescue them. But...

-

PRA NAO DIZER QUE EU NAO FALEI DE ... VELHINHOS, PREVIDENCIA E JUSTICA INTERGERACIONAL The pensions crisis or everything you need to know about your future but may be too scared to ask 12 October 2004 http://money.independent.co.uk/personal_finance/pensions/story.jsp?story=571242 ...

Economia

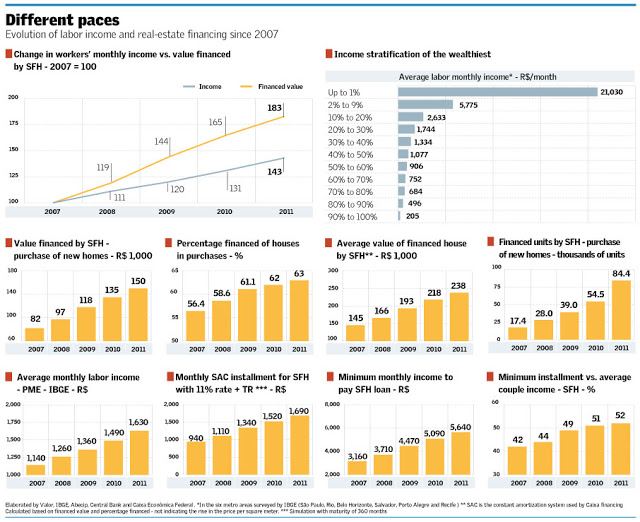

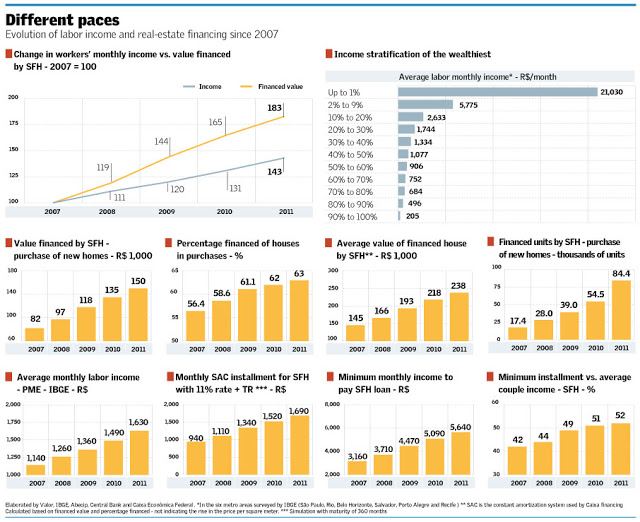

Discrepância entre renda e credito imobiliário

(An excerpt from a recent article at Valor Economico)

“In the past few years, the value of houses rose much more than the Brazilians’ income, generating a mismatch between the capacity of families to contract debt and real-estate financing. While the average income of Brazilian workers rose 43% between 2007 and 2011, the average value of financing for acquisition of real estate done by the Housing Finance System, or SFH, which uses funds managed by the government, increased 83%. New financing rules announced recently by Caixa Economica Federal, the state-owned bank that manages most funds to finance housing, tend to ease access of new families to such credit.

In 2007, average loans were R$82,000 and monthly installments were absorbing 42% of an average Brazilian couple’s income, considering a 30-year maturity. Last year, average financing reached R$150,000, with initial installments accounting for 52% of the couples’ income.

Mais

“In the past few years, the value of houses rose much more than the Brazilians’ income, generating a mismatch between the capacity of families to contract debt and real-estate financing. While the average income of Brazilian workers rose 43% between 2007 and 2011, the average value of financing for acquisition of real estate done by the Housing Finance System, or SFH, which uses funds managed by the government, increased 83%. New financing rules announced recently by Caixa Economica Federal, the state-owned bank that manages most funds to finance housing, tend to ease access of new families to such credit.

In 2007, average loans were R$82,000 and monthly installments were absorbing 42% of an average Brazilian couple’s income, considering a 30-year maturity. Last year, average financing reached R$150,000, with initial installments accounting for 52% of the couples’ income.

Mais

loading...

- Os Novos Ricos, Que Afinal Somos

Qualquer semelhança com a nossa realidade não será pura coincidência: An African American family with the same income, family size, and other demographics as a white family will spend about 25 percent more of its income on jewelry, cars, personal...

- O Programa Para A Participação "voluntária" Dos Investidores Privados

De acordo com um documento divulgado pelo Institute of International Finance, o programa para a participação "voluntária" dos privados envolverá a troca dos títulos de dívida gregos por uma combinação de quatro instrumentos: "1) A Par Bond Exchange...

- Previdência

— BRAZIL: Brazil is ranked second-best of 20 countries evaluated by the Center for Strategic and International Studies for maintaining retirees' incomes. But it's only No. 18 in its ability to pay for its retirement system over the long term....

- Bailout - Quem Recebe "ajuda"?

Matt Tibbi: "... There are plenty of people who have noticed, in recent years, that when they lost their homes to foreclosure or were forced into bankruptcy because of crippling credit-card debt, no one in the government was there to rescue them. But...

-

PRA NAO DIZER QUE EU NAO FALEI DE ... VELHINHOS, PREVIDENCIA E JUSTICA INTERGERACIONAL The pensions crisis or everything you need to know about your future but may be too scared to ask 12 October 2004 http://money.independent.co.uk/personal_finance/pensions/story.jsp?story=571242 ...