Chega de Maluquice!

Esta é a mensagem central do artigo de John Taylor no WSJ:

"It's been three years since the financial crisis flared up and the recession began. Yet the unemployment rate is still over 9%—double what it was before the recession—and it's been stuck above 9% for 20 consecutive months. Why the extraordinarily high and prolonged unemployment? My research shows that discretionary government interventions—deviations from sound economic principles and policies—have been largely responsible."

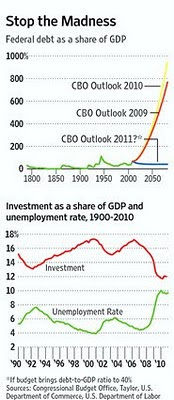

"They should start by laying out a credible plan to reduce spending and stop the debt explosion. If spending as a share of GDP can be brought to 2000 levels and held there with entitlement reforms, then the budget can be balanced without employment-retarding tax-rate increases. A concrete goal should be to establish a long-term budget that the Congressional Budget Office (CBO) can credibly show would bring the debt-to-GDP ratio to 40%. If the plan is ready for this summer's CBO long-term projections, it will give an immediate boost to economic growth and job creation as uncertainty about debt sustainability falls. An example of what the CBO's next projection might look like is shown in the nearby chart of U.S. debt history along with the CBO's projections made in 2009, 2010 and, if the plan is ready, in 2011.

Some want to delay reducing government spending because of high unemployment and the fragile recovery. But there is no convincing evidence that a gradual and credible reduction in government purchases will increase unemployment. The history of the past two decades shows that lower government purchases as a share of GDP are associated with lower unemployment rates. A much better way to reduce unemployment is to encourage private investment. Over the past two decades, unemployment fell when investment increased as a share of GDP. (See the other nearby chart.)

Meanwhile, the Fed should lay out a plan for reducing its extraordinarily large balance sheet. To achieve a more predictable rules-based policy going forward, the Fed's objectives should be clarified. The Federal Reserve Act now says the Fed must "promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates." But too many goals blur responsibility and accountability and they allow for confusing changes in emphasis from one goal to another."

- Fed Adota Virtual Regime De Metas Para A Inflação

Release Date: January 25, 2012For release at 2:00 p.m. EST Following careful deliberations at its recent meetings, the Federal Open Market Committee (FOMC) has reached broad agreement on the following principles regarding its longer-run goals and monetary...

- A Dinâmica Da Dívida Pública

There are two things that matter in government-debt dynamics: the difference between real interest rates and GDP growth (r-g), and the primary budget balance as a % of GDP (ie, before interest payments). In any given period the debt stock grows by the...

- Dinâmica Da Dívida Pública

Debt dynamics The maths behind the madness The Economist online Our interactive guide to reducing government debtGOVERNMENT debt dynamics, once an esoteric subject of interest only to macroeconomists, are suddenly in vogue. With Greece...

- A Dinâmica Da Dívida Pública

Debt dynamics- The maths behind the madness-The Economist online GOVERNMENT debt dynamics, once an esoteric subject of interest only to macroeconomists, are suddenly in vogue... Veja aqui a mapa interativa da dívida pública There are two things that...

- "quantitative Easing"

Bernanke’s Fed, constrained by a key interest rate near zero and bound by a Congressional mandate to reduce unemployment, yesterday said it would buy $600 billion in Treasury securities through next June in a bid to further reduce long-term borrowing...