Economia

Mais

- A Crisa Da Dívida Europeia

...

- Dívida Pública - Mapa Global Interativa Da Dívida Dos Países

World debt comparison The global debt clock Our interactive overview of government debt across the planet The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is...

- Fim Do Jogo

Endgame: The End of the Debt SuperCycle and How It Changes Everything Greece isn’t the only country drowning in debt. The Debt Supercycle—when the easily managed, decades-long growth of debt results in a massive sovereign debt and credit crisis—is...

- O Relógio Da Dívida

World debt comparison The global debt clock Our interactive overview of government debt across the planet The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar...

- A Orígem Da Crise Europeia

To Thrive, Euro Countries Must Cut Welfare State By Fredrik Erixon "...Take the four countries at the epicenter of the euro-area crisis: Greece, Ireland, Portugal and Spain. They are in many ways different, but they have three important characteristics...

Economia

O mundo em dívida

Global Debt:

Global Debt:

Living In A Free-Lunch World

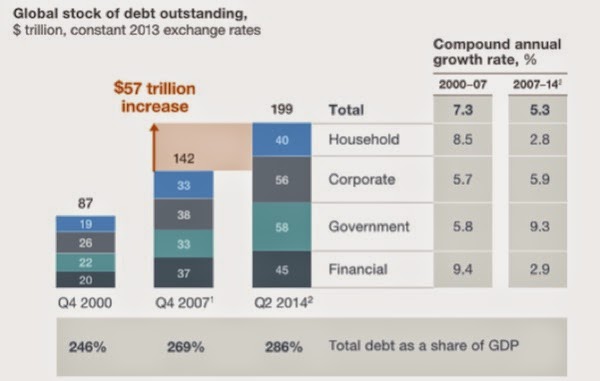

The world has been on a debt binge, increasing total global debt more in the last seven years following the financial crisis than in the remarkable global boom of the previous seven years (2000-2007)! This explosion of debt has occurred in all 22 “advanced” economies, often increasing the debt level by more than 50% of GDP. Consumer debt has increased in all but four countries: the US, the UK, Spain, and Ireland (what these four have in common: housing bubbles). Alarmingly, China’s debt has quadrupled since 2007. The recent report from the McKinsey Institute, cited above, says that six countries have reached levels of unsustainable debt that will require nonconventional methods to reduce it (methods otherwise known as defaulting, monetization; whatever you want to call those measures, they amount to real pain for the debtors, who are in many cases those least able to bear that pain). It’s not just Greece anymore. Quoting from the report:Mais

loading...

- A Crisa Da Dívida Europeia

...

- Dívida Pública - Mapa Global Interativa Da Dívida Dos Países

World debt comparison The global debt clock Our interactive overview of government debt across the planet The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is...

- Fim Do Jogo

Endgame: The End of the Debt SuperCycle and How It Changes Everything Greece isn’t the only country drowning in debt. The Debt Supercycle—when the easily managed, decades-long growth of debt results in a massive sovereign debt and credit crisis—is...

- O Relógio Da Dívida

World debt comparison The global debt clock Our interactive overview of government debt across the planet The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar...

- A Orígem Da Crise Europeia

To Thrive, Euro Countries Must Cut Welfare State By Fredrik Erixon "...Take the four countries at the epicenter of the euro-area crisis: Greece, Ireland, Portugal and Spain. They are in many ways different, but they have three important characteristics...