Economia

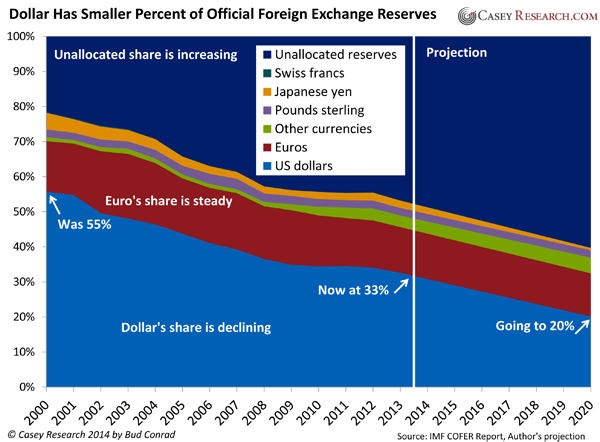

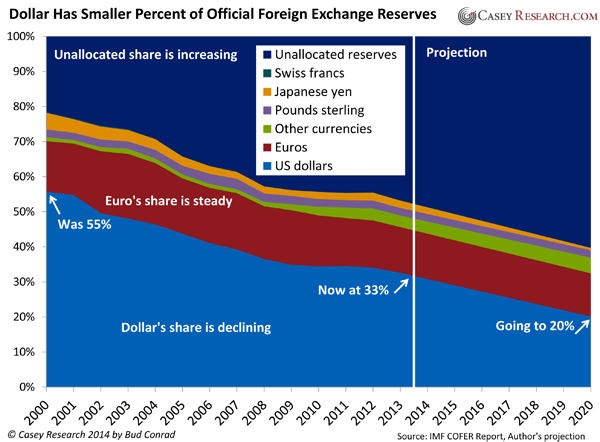

After World War II, the dollar became the world’s preeminent currency. Convertible to gold at $35 an ounce, it was the backbone of international trade. Foreign central banks used it to back their own currencies.

Nixon removed the dollar’s convertibility to gold in 1971, rendering its value dependent on prudent management by its issuer. That issuer, of course, is the Federal Reserve—which conjures dollars into existence to support the US government’s spending habit.

The Fed has issued a lot of dollars since 1971, and even more since the financial crisis of 2008—thanks to Washington’s exploding debt levels. And it’s only going to get worse, as even the Congressional Budget Office (CBO) admits in its own forecasts.

What’s more, CBO debt estimates are notoriously overoptimistic; so while they are daunting, reality will likely be worse. To paint a realistic picture of future US debt levels, I added 20% to the CBO’s forecast, illustrated here:

Mais

- Banco Central Do Brasil Compra Ouro

The IMF reported Wednesday that the Banco Central do Brasil has increased its gold holdings for the second straight month, to the highest level in 11 years, as Latin America’s biggest economy looks to diversify its vast international reserves. Brazil’s...

- O Relógio Da Dívida

World debt comparison The global debt clock Our interactive overview of government debt across the planet The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar...

- Hegemonia Do Dólar Americano Em Debate

For more than half a century, the U.S. dollar has been not just America's currency but the world's. It is used globally by importers, exporters, investors, governments and central banks alike. Nearly three-quarters of all $100 bills circulate...

- Os Estados Unidos Perto Da Bancarotta

Is the United States Bankrupt? Laurence J. Kotlikoff ".. Many would scoff at this notion. They’d point out that the country has never defaulted on its debt; that its debt-to-GDP (gross domestic product) ratio is substantially lower than that...

- Os Brics E O Dólar

BRICs Will Not Mull New Reserve CurrenciesRUSSIA, CHINA, INDIA, BRAZIL, CURRENCIES, ECONOMY, GLOBALReuters | 14 Jun 2009 | 07:43 PM ET Leaders of Russia, China, India and Brazil do not intend to discuss new global reserve currencies at their first summit...

Economia

A posição dos Estados Unidos e do dólar na economia mundial

The Dollar Under Siege

Nixon removed the dollar’s convertibility to gold in 1971, rendering its value dependent on prudent management by its issuer. That issuer, of course, is the Federal Reserve—which conjures dollars into existence to support the US government’s spending habit.

The Fed has issued a lot of dollars since 1971, and even more since the financial crisis of 2008—thanks to Washington’s exploding debt levels. And it’s only going to get worse, as even the Congressional Budget Office (CBO) admits in its own forecasts.

What’s more, CBO debt estimates are notoriously overoptimistic; so while they are daunting, reality will likely be worse. To paint a realistic picture of future US debt levels, I added 20% to the CBO’s forecast, illustrated here:

Mais

loading...

- Banco Central Do Brasil Compra Ouro

The IMF reported Wednesday that the Banco Central do Brasil has increased its gold holdings for the second straight month, to the highest level in 11 years, as Latin America’s biggest economy looks to diversify its vast international reserves. Brazil’s...

- O Relógio Da Dívida

World debt comparison The global debt clock Our interactive overview of government debt across the planet The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation is familiar...

- Hegemonia Do Dólar Americano Em Debate

For more than half a century, the U.S. dollar has been not just America's currency but the world's. It is used globally by importers, exporters, investors, governments and central banks alike. Nearly three-quarters of all $100 bills circulate...

- Os Estados Unidos Perto Da Bancarotta

Is the United States Bankrupt? Laurence J. Kotlikoff ".. Many would scoff at this notion. They’d point out that the country has never defaulted on its debt; that its debt-to-GDP (gross domestic product) ratio is substantially lower than that...

- Os Brics E O Dólar

BRICs Will Not Mull New Reserve CurrenciesRUSSIA, CHINA, INDIA, BRAZIL, CURRENCIES, ECONOMY, GLOBALReuters | 14 Jun 2009 | 07:43 PM ET Leaders of Russia, China, India and Brazil do not intend to discuss new global reserve currencies at their first summit...